Wake County median prices reached a new high

Wake County August 2020 real estate activity remained steady at levels comparable with pre-COVID-19 periods. August activity was overall consistent with June and July results.

Charles P. Gilliam, the Register of Deeds, commented “we are now seeing a case of ‘no news is good news.’ The real estate market is moving along steadily, appearing unaffected by difficulties severely impacting some sectors.”

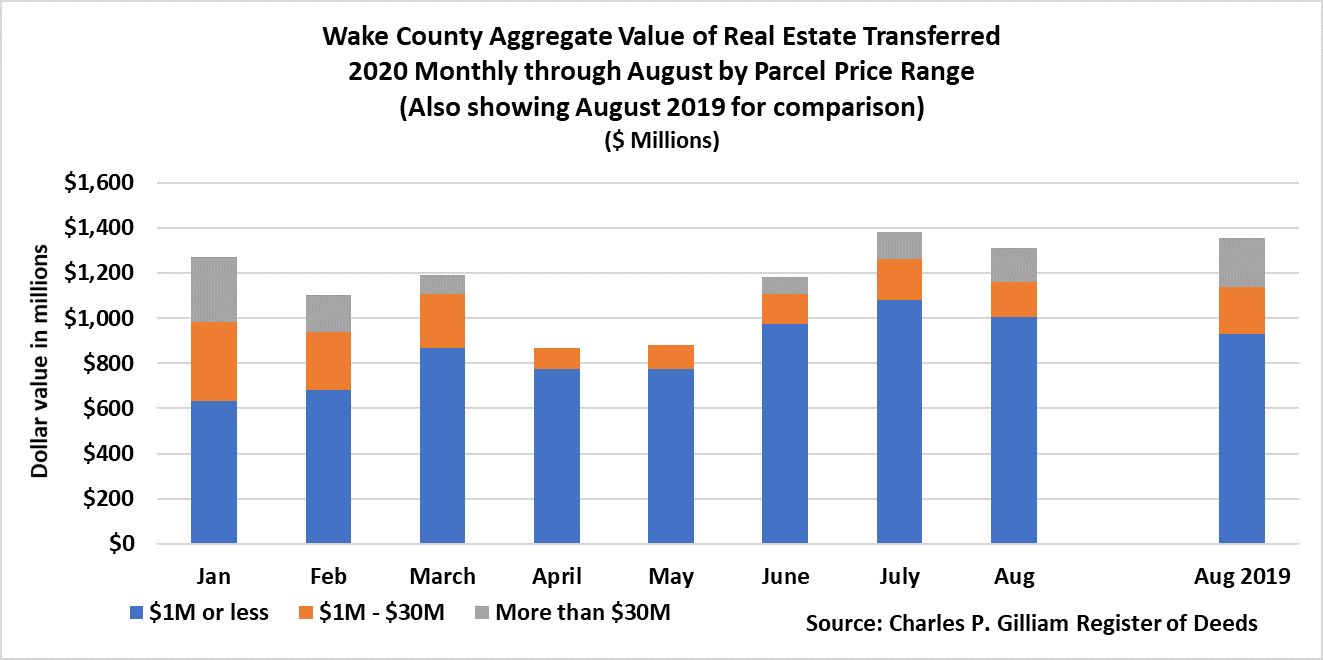

August dollar value of transactions

During August 2020 core market transactions were $1.0 billion, up 8%, or $78 million, compared to August 2019, but down 7%, or $72 million, compared to July 2020.

The core market is defined as property valued at $1 million or less and it comprised about 97% of August’s transactions.

Overall, in August 2020 the dollar value of transactions was $1.3 billion which was $46 million lower than August 2019 and $73 million lower than July 2020.

The largest closing in August 2020 was Metropolitan Apartments at 314 West Jones Street, Raleigh for $65 million.

A breakdown of the dollar value of transactions by price range for the years 2014 – 2019 is available at http://www.wakegov.com/news/Lists/Posts/Post.aspx?ID=1140

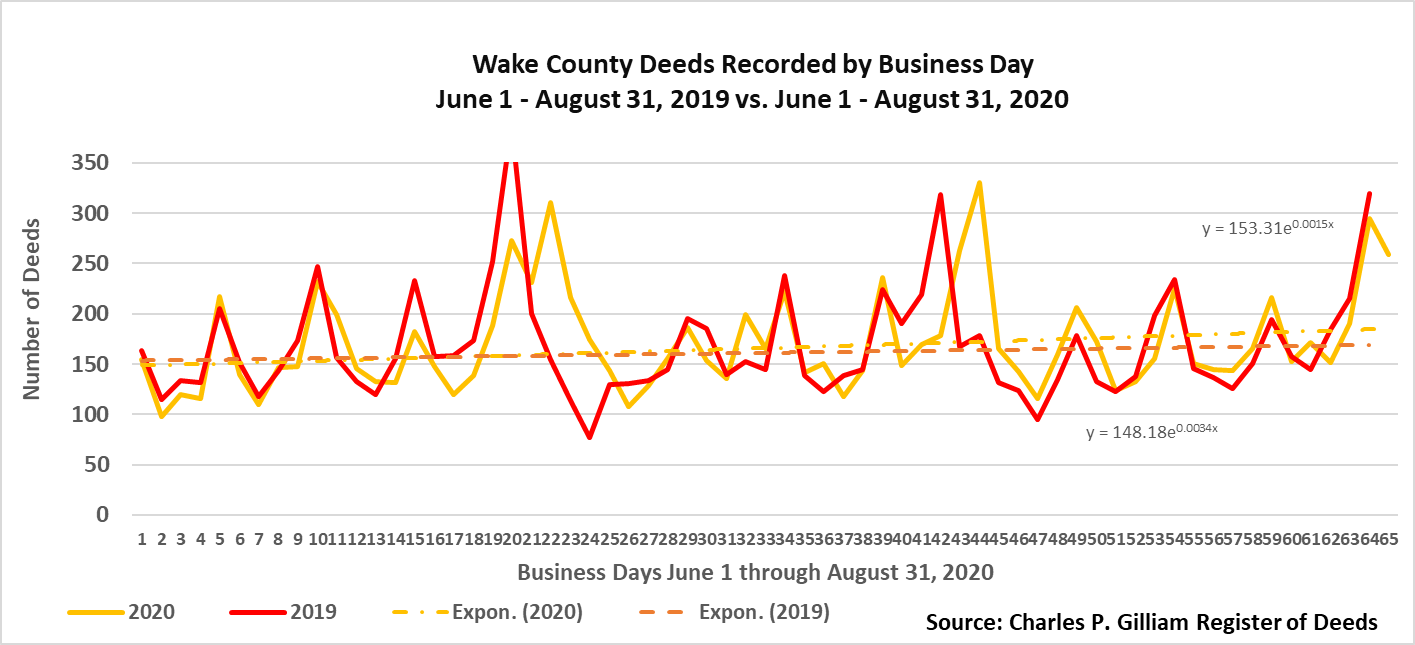

Deed volume remains steady at pre-COVID-19 restrictions levels

The pace of recording deeds during August 2020 remained steady at pre-COVID levels, consistent with results for the other two summer months, June and July.

3,643 deeds were recorded in August, compared to 3,870 in July and 3,612 in August 2019. The August pace was a mean of 173 deeds per business day compared to 176 in July 2020 and 164 in August 2019.

The following chart shows the daily number of deeds recorded in June through August 2020 compared to the corresponding period of 2019. The exponential trend line for 2020 is stronger compared to 2019.

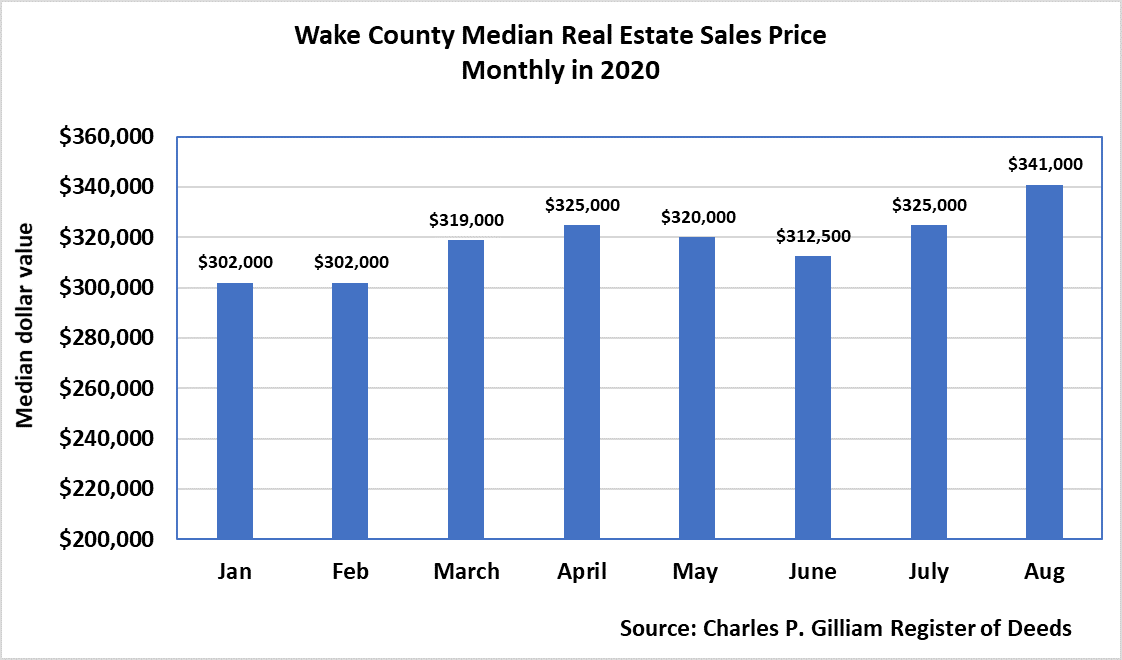

August median sales price achieved a new high

In August 2020 the median price of a parcel of Wake County real estate was $341,000, a new high.

The median Wake County real estate sales price for the second quarter of 2020 was $322,500. For both the first quarter of 2020 and the fourth quarter of 2019 the median was $310,000. Abreakdown of medians for the years 2014 – 2019 is available at http://www.wakegov.com/news/Lists/Posts/Post.aspx?ID=1140

Changes in median sales prices tend to be caused by activity in the core market. The occurrence or non-occurrence of large transactions has virtually no impact on the calculation of median values because there are so few of those transactions.

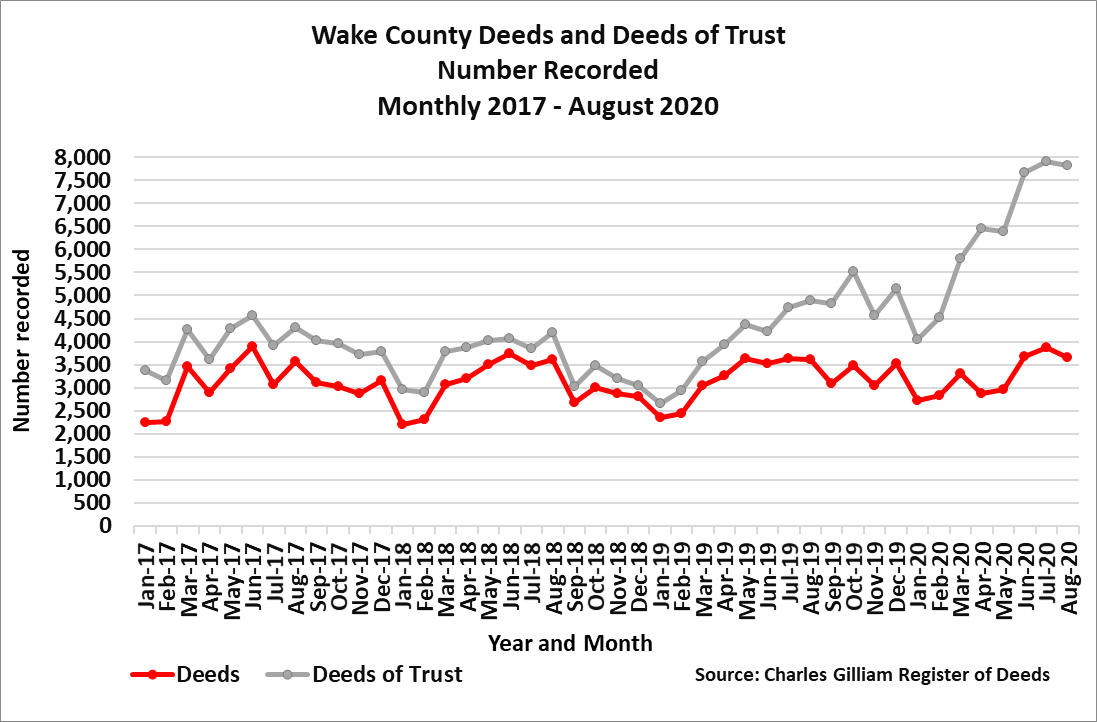

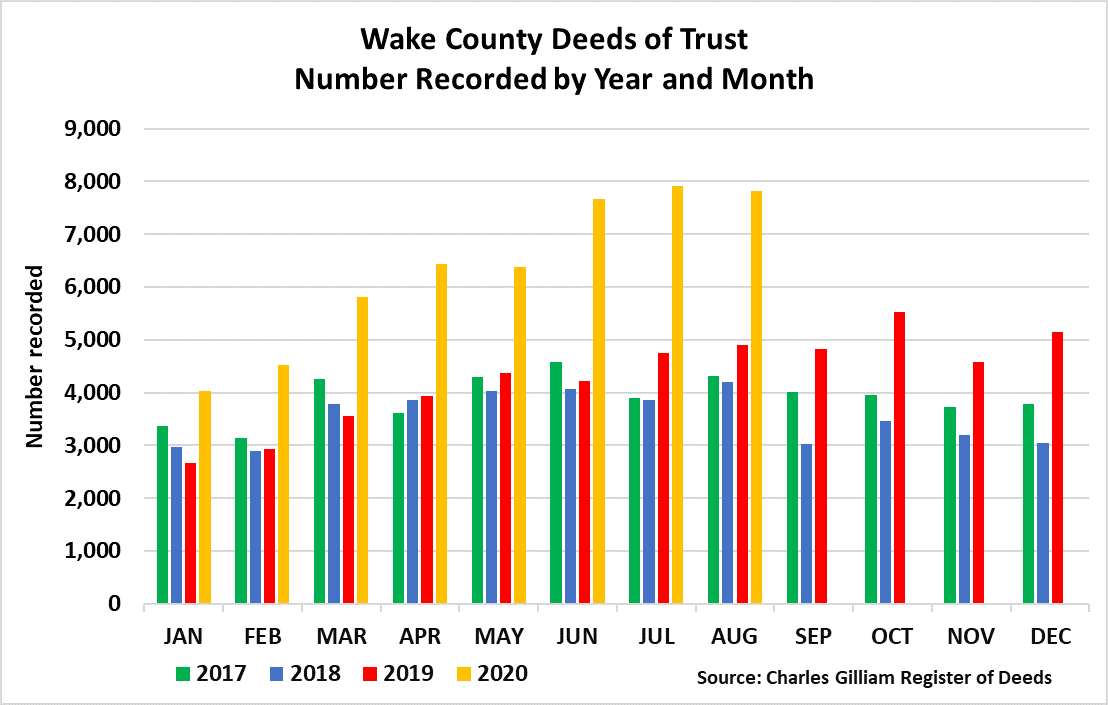

Lending activity continues to be propelled by refinancing

Real estate lending activity in August was consistent with June and July as all three summer months saw strong refinance activity. The number of loans secured by real estate was up 60% compared to August 2019.

Real estate lending activity has two primary components.

1. The first is lending that coincides with a transfer of ownership of real estate. This is seen in the typical residential home sale where simultaneously a seller’s loan is paid off and a buyer takes out a new loan as ownership is transferred by deed.

2. The second is where a new loan secured by real estate is taken out, but there is not a change in ownership of the underlying property. This is the situation in the typical mortgage refinancing or second mortgage transaction.

The relative strength of the second type of lending activity can be quantified by comparing the ratio of deeds of trust to deeds in a period. Relatively more deeds of trust signify increasing refinance of mortgage loans.

Since the autumn of 2019, there has been a significant increase in the second type of lending activity. The following chart shows the continuing wide gap between deeds of trust and deeds. This gap, compared to a baseline period from 2017 through mid-2019, quantifies increasing strength in the mortgage refinance market.

Long-Term Trends in Real Estate Activity

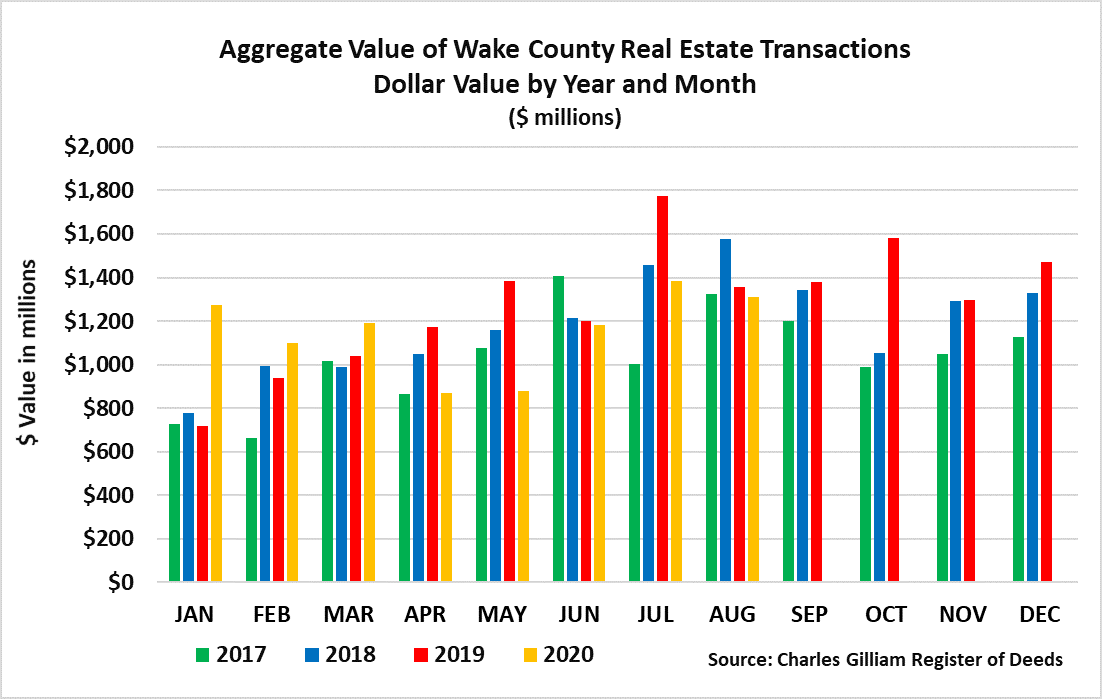

Aggregate value of real estate transactions

The following chart shows the aggregate dollar value of real estate transactions in Wake County for each month from 2017 through 2019 as well as year to date 2020. Because real estate transactions tend to be seasonal, it is useful to compare monthly results to the corresponding month of prior years.

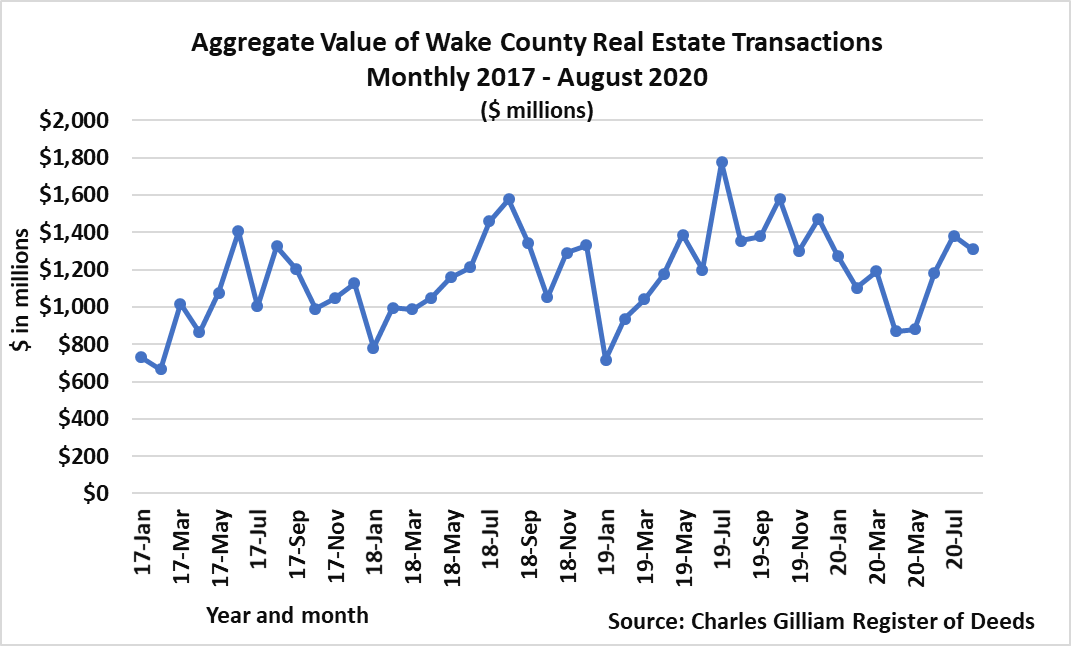

Aggregate value of real estate transactions – linear

The following chart shows the aggregate dollar value of real estate transfers in Wake County linearly (month by month) from January 2017 through year to date 2020. Because real estate transactions tend to be seasonal, this information should be evaluated in conjunction with the year over year comparison shown in the preceding chart.

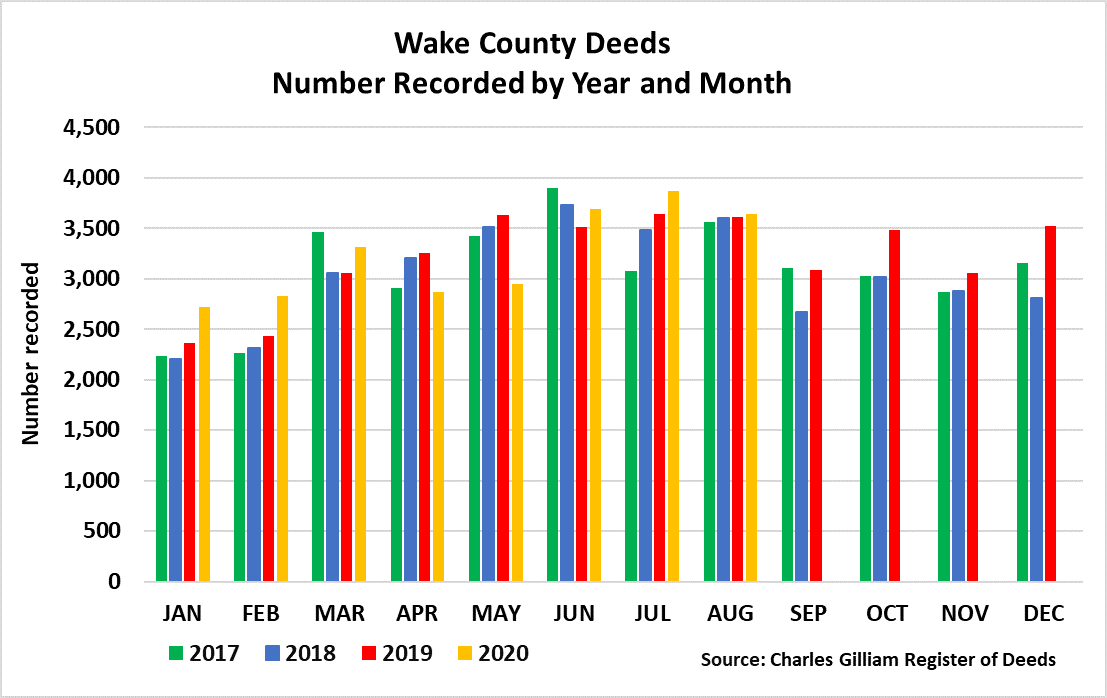

Deed volume

The following chart shows the number of deeds recorded in Wake County for each month from 2017 through 2019 as well as year to date 2020. The numbers of deeds recorded reflect the velocity of real estate activity without regard to the dollar value of a transaction. The number of deeds includes transfers where monetary consideration did not change hands, such as transfers within a family.

Real estate lending

This chart shows the number of deeds of trust recorded in Wake County for each month from 2017 through 2019 as well as year to date 2020. A deed of trust is the legal instrument used in North Carolina to secure a loan with real estate used as collateral. The numbers of deeds of trust recorded reflect the velocity of lending transactions involving real estate without regard to the dollar amount of the loan.

Methodology and Additional Information

The statistics in this report are derived from instruments recorded in the office of the Wake County Register of Deeds. Under North Carolina law, changes in property rights in real estate, including security interests in real estate, are recorded with the Register of Deeds of the county where the real estate is located.

The value of real estate transferred is measured by excise tax assessed on the consideration in a real estate transaction. Excise taxes are calculated as $1 in tax for every five hundred dollars of consideration. About 99% of these transactions were property transfers by deed and the balance were miscellaneous transactions such as acquisitions of a right of way. The calculation of the aggregate value of real estate includes all transactions. The calculation of median price includes all transactions where property was transferred by deed.

The core market is defined as property transactions valued at $1 million and less. In August 2020, 97% of transactions were in the core market.

The number of deeds and deeds of trust recorded with the Register of Deeds reflects the total volume of property and loan transactions regardless of the dollar value of the real estate or amount of the loan. The number of deeds includes transfers where monetary consideration did not change hands, such as transfers within a family. In August 2020, 22% of deeds attracted no excise tax. In the first quarter, that percentage was 21% and it was 22% in the second quarter of 2020.

On March 14, 2020, public schools were closed, and mass gatherings were prohibited by executive order of the governor. On March 17 and 23, 2020 additional executive orders were issued which closed certain businesses and introduced additional restrictions. Based on these events, a starting date of March 17 is used to demark the advent of COVID-19 related legal restrictions on economic activity.

For a complete picture of Wake County real estate activity, the information in this report should be considered in conjunction with data available from other sources, such as rezoning applications and new building permits, plus other information published by the Register of Deeds available at http://www.wakegov.com/news/Lists/Categories/Category.aspx?CategoryId=17&Name=Register%20of%20Deeds .

This report was initially released on September 3, 2020.

http://www.wakegov.com/news/Lists/Posts/Post.aspx?ID=1330&utm_source=newsletter&utm_medium=email&utm_campaign=press_release_august_2020_real_estate_activity_remained_steady_at_levels_consistent_with_pre_covid_19_periods&utm_term=2020-09-03

Leave A Comment